50% YoY Surge in Core Segment Sales with 30% Revenue Growth and a Geopolitical Moat - NAURA Technology Group

Deep Dive into China's National Champion, Capitalizing on the Multi-Billion Dollar Localization Wave with the Broadest State-Backed Product Arsenal in the Domestic Market.

Markets have a strange habit: they obsess over uncertainty while ignoring evidence.

We have all the data we need: revenues compounding, margins expanding, leadership entrenched, yet investors prefer to chase narratives instead of numbers.

NAURA Technology Group stands as a perfect case study. Record growth, dominant positioning, clear strategic tailwinds, and still, the market hesitates. Fear of what might go wrong is blinding it to what is going right.

That gap between perception and reality? That’s where the best returns are made.

Record Growth, Cold Reception.

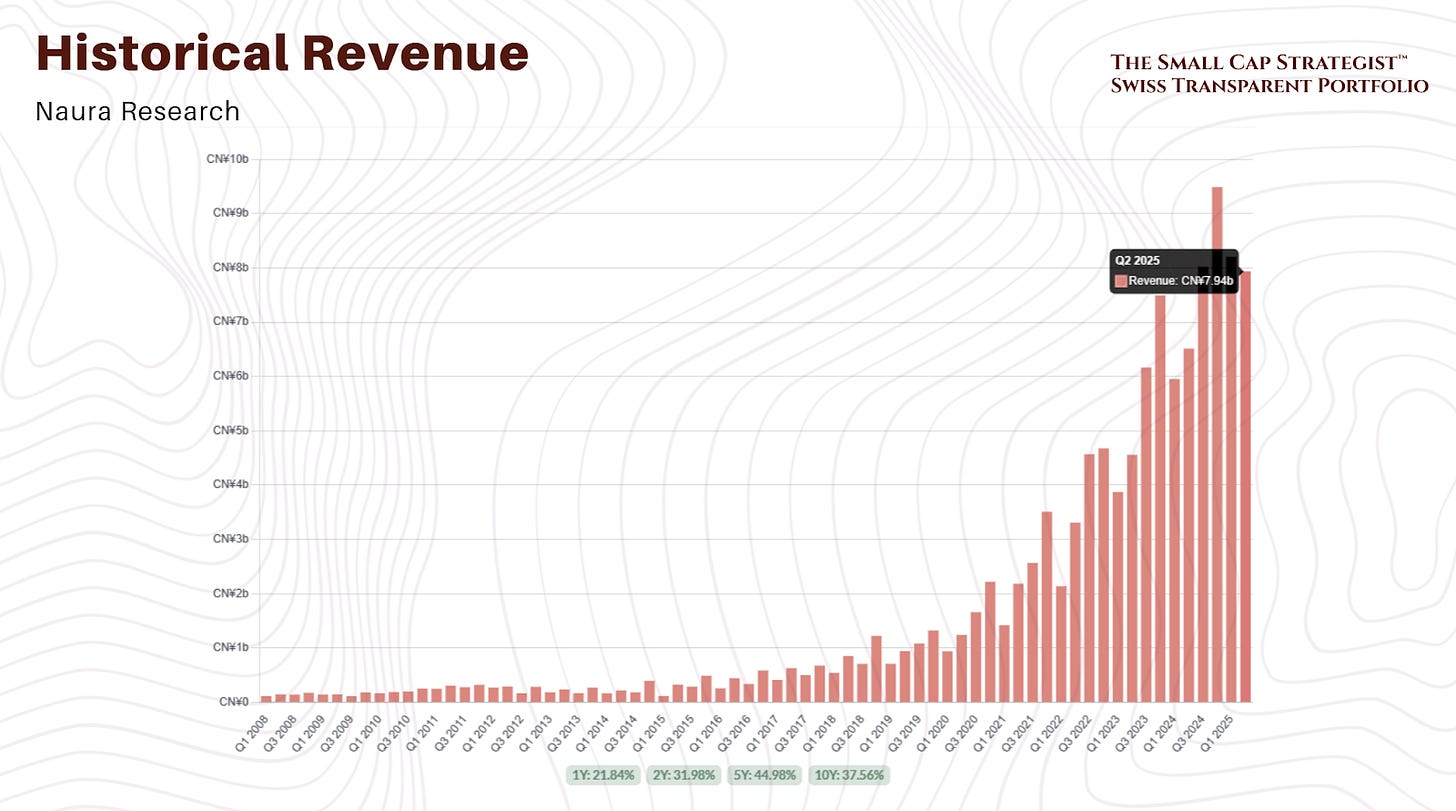

The chart says it all: NAURA Technology Group’s revenues have been compounding at breakneck speed, with Q2 2025 hitting CNY 7.94 billion, part of a 29.5% surge in H1 2025 sales to CNY 16.14 billion. Net profit followed suit, up 15% to CNY 3.21 billion.

And yet, instead of fireworks, the stock market handed NAURA a cold shower: shares slid ~6% on August 28, 2025, the very day of the earnings release. This disconnect, strong fundamentals, weak investor reaction, hints at a potential contrarian setup. Is Mr. Market underestimating the staying power of China’s largest semiconductor equipment maker and its central role in the country’s tech self-sufficiency drive?

Inside This NAURA Equity Research

Business Segments

From etch to batteries, the hidden industrial empire behind NAURA’s ¥29.8 billion revenue, and which division is quietly compounding faster than the headlines suggest.

SWOT Analysis

State protection, cash burn, valuation stretch, and a geopolitical coin-flip: NAURA’s strategic strengths and vulnerabilities dissected with surgical precision.

Operational Overview

How “orders full” really looks on the ground. Capacity expansion, product mix, and the quiet supply-chain choke points the market keeps missing.

Growth Drivers

China’s self-sufficiency rocket. A thirty-tool product arsenal. Strategic acquisitions. And R&D intensity few Western peers can match.

Competitive Landscape

Everyone wants a piece of the fab. Why NAURA still plays on a different level, and what its “national champion” status truly delivers.

Valuation & Peers

What the market is missing when it prices NAURA below its smaller domestic rivals.

Management

Technocrats or policymakers in disguise? Meet the engineers executing a national industrial strategy rather than chasing quarterly optics.

Long-Term Outlook & Key Risks

The bet on sustained tension: how far Beijing’s shield can carry NAURA, and what happens if geopolitics swing from controlled friction to cooperation.

Conclusion

When growth, policy, and valuation collide, does this remain an asymmetric opportunity, or a fully priced dream?

This analysis is the second installment of our special four-part series in collaboration with The Small Cap Strategist.

We are deconstructing the four pillars of the semiconductor equipment industry; the companies building the machinery that powers our digital world.

Our first deep dive was on the American champion, Lam Research. In that report, we covered:

The “Complexity is Cash Flow” Moat: Why Lam’s dominance becomes more critical as chips evolve into 3D skyscrapers.

Riding the AI Tsunami: How Lam’s technology is an indispensable enabler for the next generation of AI processors.

A Valuation Deep Dive: A complete analysis of Lam’s valuation against key peers like ASML and Applied Materials.

The Geopolitical Chessboard: A breakdown of the immense China paradox and other primary risks.

Today, we turn our focus to China’s national champion. To give you a sharper collateral on a sector entirely dependent on semiconductors, we’ve published one of the most in-depth free deep dives on Generative AI you’ll find online, a real blueprint for where the industry is heading:

At Swiss Transparent Portfolio and The Small Cap Strategist, we’ve made it our mission to uncover hidden opportunities before the crowd. Our research community is built for investors who want an edge:

Institutional-grade analysis usually locked behind paywalls.

Unrivaled diligence, creative, painstaking work others avoid.

A proven record of identifying global compounders that consistently beat the market.

This isn’t just research, it’s a blueprint for compounding wealth with conviction. And if you haven’t yet, check some of our winners, proof that conviction pays:

And our potential future compounders? They’re already lining up for the next leg of the journey:

If you want to understand not only where technology is headed, but also how to capture the hidden compounding opportunities that enable it, subscribe to Swiss Transparent Portfolio and The Small Cap Strategist.

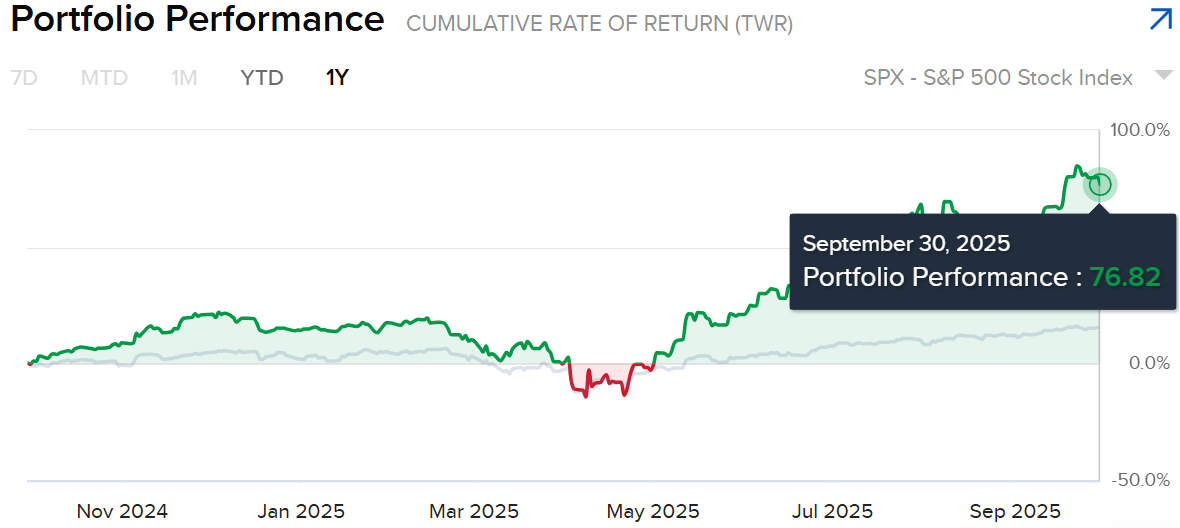

Big news at Swiss Portfolio

Enjoying these portfolio updates?

Full access is just $39.99/year, less than a Swiss train ticket & more value and transparency than most $300+ memberships out there.

💥 2025 Special: Join this year and lock in $39.99/year for life. No future price hikes, your rate stays fixed forever. Don’t miss it. Click the button above.

Over the past 12 months, our portfolio has returned close to 6x the S&P 500, and we publish every move with full transparency. In a world where most of finance hides behind paywalls and vague claims, we do things Swiss-transparently.

That’s not by chance. It’s the result of deep research, disciplined capital allocation, and a focus on durable, capital-light compounders, with strong management, sector tailwinds, and attractive valuations, often well before they’re widely recognized.

Become a member and you’ll gain full access to:

✅ Full access to Swiss Portfolio positions + monthly allocation updates.

✅ At least 1 high-conviction Equity Research every month.

✅ Downloadable financial models to follow and stress-test each thesis.

✅ Live idea tracking once they spike, plus an S&P tracking template.

✅ Exclusive Swiss-based insights on investing, residence, and tax optimization.

✅ Special Situations: asymmetric opportunities, arbitrage plays and odd-lot tenders.

🧠 The $39.99 subscription pays for itself a few times over, sometimes in just one Equity Research idea. This isn’t about hype. It’s about transparency, consistency, and long-term compounding.

If you share our philosophy of identifying scalable compounders in high-quality jurisdictions backed by durable megatrends, we strongly encourage you to explore how past ideas have performed (current date 2.10 before market open) :👇

Business Segments

NAURA is a platform player with four major business lines:

Semiconductor fabrication equipment, its core segment, including etch systems, thin-film deposition (PVD/CVD), oxidation/diffusion furnaces, cleaning and annealing tools. This is the beating heart of NAURA, serving chip fabs.

Vacuum technology equipment, industrial furnaces for heat treatment, crystal growth, and materials processing used in new energy, materials, and aerospace applications.

Lithium battery equipment, production line machinery (mixers, coaters, winders, etc.) for battery cell manufacturing, riding the EV wave.

Precision components, electronic components like precision resistors, capacitors, crystal oscillators, power modules, often used in aerospace and industrial electronics.

Semiconductor equipment is by far the largest revenue driver. In 2024 NAURA’s semi tool sales hit ~CNY 21 billion (out of CNY 29.8 billion total), and in H1 2025 this segment generated over CNY 13 billion, over 80% of total sales. By our estimates, semi equipment revenues surged ~50% YoY in H1, reflecting NAURA’s pivotal role in China’s fab expansion. Key product categories are firing on all cylinders: etching tools contributed ~¥5 billion in H1, deposition ~¥6.5 billion, thermal processing ~¥1 billion, and cleaning ~¥0.5 billion. These four categories alone now make up >80% of sales (up from ~70% a year prior), indicating NAURA’s increasingly semiconductor-focused mix.

The other segments, vacuum equipment, lithium battery lines, and components, form the remaining ~20%. These grew more modestly and carry lower margins.

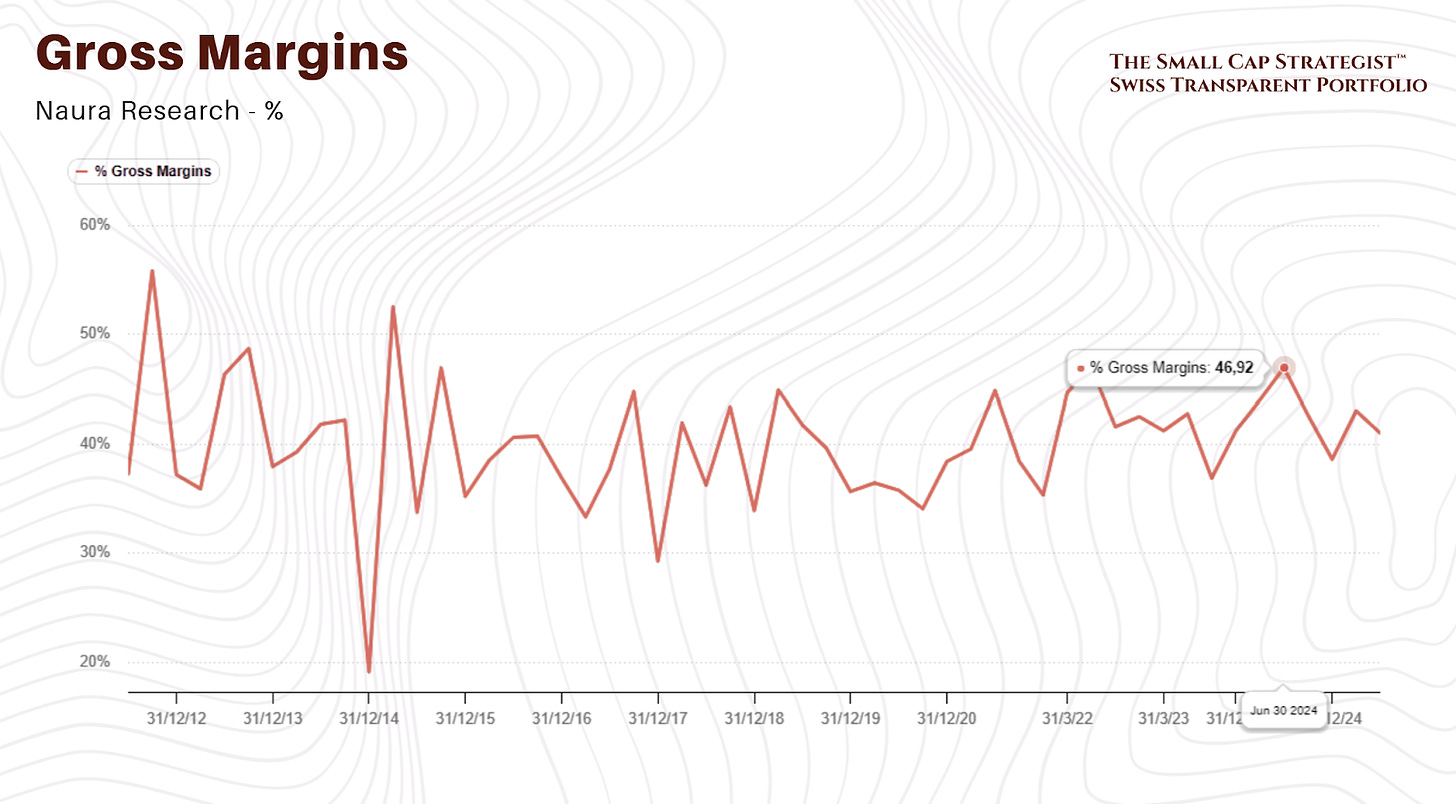

In fact, NAURA’s Q2 2025 gross margin slid to ~41% (down 6 percentage points YoY) partly because the electronic components business (a smaller segment) has relatively low profitability. It’s a classic case of mix shift: as fast-growing chip tool sales dominate, they temporarily pressured margins (more on margins later).

Still, NAURA’s diversification beyond chips is a strategic strength. Its vacuum furnaces serve niches like photovoltaics, ceramics and magnetic materials, providing a revenue buffer when cyclical semiconductor demand dips. Meanwhile, the lithium battery equipment unit taps into China’s booming EV battery industry. These adjacent segments broaden NAURA’s addressable market and embed it across China’s industrial tech supply chains.

Looking ahead to late 2025 and 2026, we expect semiconductor equipment to remain the growth engine. China is adding dozens of new fabs and upgrading existing ones, a bonanza for NAURA’s etchers, deposition and cleaning tools. The company’s order book in mature nodes (28nm and above) should stay healthy as local foundries (SMIC, HuaHong, etc.) ramp capacity, especially for auto and AI chips under 14nm where NAURA’s tools are increasingly viable. The vacuum and battery equipment segments could see incremental growth from China’s push in solar, advanced materials and EV batteries, though these likely stay a smaller slice of the pie. Overall, NAURA’s multi-pronged portfolio offers both high-octane growth (in chip gear) and steady ancillary revenue streams, a combination positioning it well through 2026 even if macro winds shift.

Keep reading with a 7-day free trial

Subscribe to Swiss Transparent Portfolio to keep reading this post and get 7 days of free access to the full post archives.