The Hidden AI Infrastructure Play: IES Holdings ($IESC)

Could Be a Silent 100x Winner in the AI Boost?

1. Summary

1.1. Investment Idea

The AI revolution isn’t just about cutting-edge algorithms and breakthrough machine learning models—it’s about the infrastructure powering it all. As Amazon, Microsoft, Google, and Meta prepare to pour over $300 billion into AI infrastructure in 2025 alone, plus the Government’s Stargate project +500 billion in the next 4 years, the demand for data centers, electrical systems, and specialized industrial solutions is reaching unprecedented levels. While the headlines focus on AI giants, the real opportunity may lie in the companies building and supporting this infrastructure. Enter IES Holdings ($IESC)—a lesser-known but strategically positioned player in the electrical, communications, and industrial infrastructure space. As AI data centers scale exponentially, IESC stands to benefit from the massive capital expenditures driving the next wave of technological transformation—and investors might be overlooking this hidden gem.

IES Holdings ($IESC) is a founder-led company (founder holds 55% of the company) that stands apart from the typical promotional playbook—rather than flashy marketing, it quietly prioritizes operational excellence and shareholder alignment. Over the years, the company has built a long track record of revenue and EPS growth, demonstrating its ability to navigate market cycles while steadily compounding value. What makes IESC particularly compelling is its pricing power, allowing it to increase prices without sacrificing demand—a strong indicator of its competitive moat in essential infrastructure services. Despite facing industry tailwinds in key segments like residential, industrial, infrastructure and communications, IESC has continued to expand its operating margins, reflecting strong cost discipline and operational efficiencies. At today’s reasonable valuation multiples, the company offers an attractive entry point, especially considering its excellent return on capital employed (ROCE) and disciplined capital allocation strategy. Instead of chasing growth for growth’s sake, IESC methodically deploys capital through buybacks and strategic M&A, further compounding shareholder value. In a market where many infrastructure players struggle to maintain profitability, IESC stands out as an under-the-radar, high-quality compounder with the ability to deliver consistent long-term returns.

1.2. Why It Is Compelling

Revenue Diversification: $IESC’s multiple business units provide stability and reduce reliance on a single market. This diversification is particularly advantageous during economic downturns or market-specific disruptions.

Growing TAM (Total Addressable Market): Key industries such as AI infrastructure, communications, infrastructure modernization and renewable energy are driving increased demand for the company's services. These sectors are expected to grow exponentially as governments and businesses prioritize digital transformation and green energy.

Strong Financial Health: Low debt levels and consistent cash flow generation enhance its resilience. IESC’s financial stability positions it to seize growth opportunities and weather macroeconomic challenges effectively.

Management Expertise: Experienced leadership with skin in the game ensures alignment with shareholder interests, the founder holds 55% of the company. The team’s strategic vision has consistently delivered value through well-executed acquisitions and organic growth.

1.3. Risks

Dependence on cyclical industries like construction and infrastructure, which can be vulnerable to economic slowdowns.

Potential labor shortages or increased costs in skilled trades, which could impact project timelines and profitability.

Competitive pressure from larger players in the space, particularly in renewable energy and telecom sectors.

Sensitivity to macroeconomic conditions, including interest rate fluctuations, government policy shifts, and supply chain disruptions.

2. Business Model

2.1. History of the Company

Founded in 1997 by Jeffrey L. Gendell, at that time managing member of Tontine Associates, L.L.C., a private investment management firm that had the majority shareholder of IES Holdings, contributed to evolve from a pure-play electrical contracting firm into a diversified holding company. Through strategic acquisitions and internal growth initiatives, it has expanded into adjacent markets, ensuring a well-rounded portfolio of services. The company’s journey reflects a commitment to adaptability and long-term value creation, with milestones that showcase its ability to capitalize on emerging market trends.

2.2. Key Concepts Regarding Its Business

IESC operates as a holding company, focusing on decentralized management for its subsidiaries. Key segments include:

Commercial & Industrial: Electrical contracting and infrastructure for large-scale projects, including manufacturing facilities and industrial plants.

Residential: Homebuilding-related electrical installations, with a focus on sustainable and energy-efficient solutions.

Communications: Structured cabling and communication services, driven by the rapid growth of data centers and 5G networks.

Infrastructure Solutions: Key power elements for Data centers, renewable energy, battery energy storage and specialty projects, including solar installations and grid modernization.

2.3. Revenue Analysis by Segments

Commercial & Industrial: Contributes ~13% of total revenue, 31% YoY growth benefiting from large-scale construction projects and industrial expansions.

Residential: ~48% of revenue, 9% YoY growth driven by the housing market and the increasing adoption of smart home technologies.

Communications: ~27% of revenue, 29% YoY growth fueled by data center and telecom expansions, particularly in urban and suburban areas.

Infrastructure Solutions: ~12% of revenue, explosive 62% YoY growth due recent data centers demand. Renewable energy markets represent also a steady growth as governments and corporations prioritize carbon neutrality.

The revenue trends across IES Holdings’ ($IESC) segments reveal a clear story of differentiated growth dynamics. The Residential segment stands out with explosive growth since 2020, soaring from under $400 million in 2020 to nearly $1.4 billion in 2024, reflecting robust demand in the housing market, increased adoption of energy-efficient solutions, and strategic pricing adjustments. The Communications segment has also demonstrated impressive acceleration, particularly from 2021 onward, driven by rising investments in data centers, e-commerce, 5G infrastructure, and structured cabling, growing consistently past $800 million by 2024. Meanwhile, the Infrastructure segment has experienced a significant turnaround, posting a remarkable 62% year-over-year growth in 2024, reaching over $350 million. This surge has been driven by increased demand for key power elements required in data centers, reflecting the rapid expansion of AI and cloud computing infrastructure. Lastly, the Commercial & Industrial segment, though stable, has experienced slower growth relative to the other areas, indicating a more mature market presence with revenues plateauing around $400 million. This diversification of revenue sources highlights IESC’s ability to capitalize on high-growth opportunities while maintaining stability in its traditional markets.

2.4. Capital Allocation

IESC has consistently reinvested in high-growth areas, while maintaining a disciplined M&A strategy. Recent investments focus on expanding capabilities in data center infrastructure, energy and communications.

The company also prioritizes shareholder value through targeted buybacks and strategic reinvestment in core businesses, recently IESC authorized a stock repurchase of $200 million, remaining $193.7 million by the end of 1Q2025.

2.5. Financial Health

Profitability: As of the fiscal year ending September 30, 2024, IES Holdings, Inc. (IESC) reported a net profit margin of approximately 7%. In the first quarter of fiscal 2025, the company achieved a net income attributable to IES of $56.3 million, reflecting a 37% increase compared to the same quarter in the previous year. This positive trend indicates ongoing improvements in operating margins.

Revenue Growth: 17.5% year-over-year growth during last 10 years, accelerating to 22% during last 5 years.

Free Cash Flow: Explosive 36% FCF growth over 10-year period.

Debt Management: Very conservative, net cash positive of 70 million.

3. Market Share

3.1. Company’s Dominance in Its Sector

IES Holdings, with its smaller market cap and focus on high-growth segments, has significant upside potential. While it may not match the scale of Quanta Services or EMCOR in the near term, its targeted approach to capturing niche opportunities positions it as a compelling growth story. Over time, IESC could bridge the valuation gap with mid-tier players like EMCOR, delivering outsized returns for investors.

3.2. Market Trends and TAM

The U.S. infrastructure market, valued at over $2 trillion, offers significant growth potential. AI infrastructure, renewable energy and telecom sectors are particularly robust, driven by technological advancements and policy initiatives. The increasing digitization of industries further expands IESC’s addressable market.

AI and battery storage, as highlighted, are expected to grow at an annual rate exceeding 20% over the next five years. This rapid expansion presents a significant opportunity for IESC to increase its market share by aligning itself with these high-growth industries. With its strategic positioning in the right markets, IESC is well-equipped to capitalize on the rising demand for innovative infrastructure solutions supporting AI and energy storage advancements.

3.3. Macro Trends

Increasing demand for data and telecom services, fueled by the rise of remote work, e-commerce, automation, IoT devices and ultimately AI surge.

Federal infrastructure spending programs aimed at modernizing aging systems.

Shift toward renewable energy sources, with solar, wind energy projects and battery energy storage gaining momentum.

3.4. Competitors

Key competitors include Quanta Services, EMCOR, MasTec, and MYR Group, each with unique focuses but overlapping service offerings. Despite its smaller size, IESC’s agility and focus on niche markets give it a competitive edge.

3.5. Market Share of Its Competitors

Quanta Services & EMCOR Group: ~12% market share each, dominating the infrastructure sector, with market caps of $46 billion and $21 billion respectively. Both companies have delivered exceptional returns, multiplying an initial investment by orders of magnitude (+4,000% and +19,000%, respectively).

MasTec: ~8% market share, with strengths in renewable energy.

IESC: With ~2% market share, IESC has significant room for growth and opportunities to capture additional market share through strategic initiatives and acquisitions. Recent investments and strong growth trends demonstrate how well-positioned the company is for future expansion.

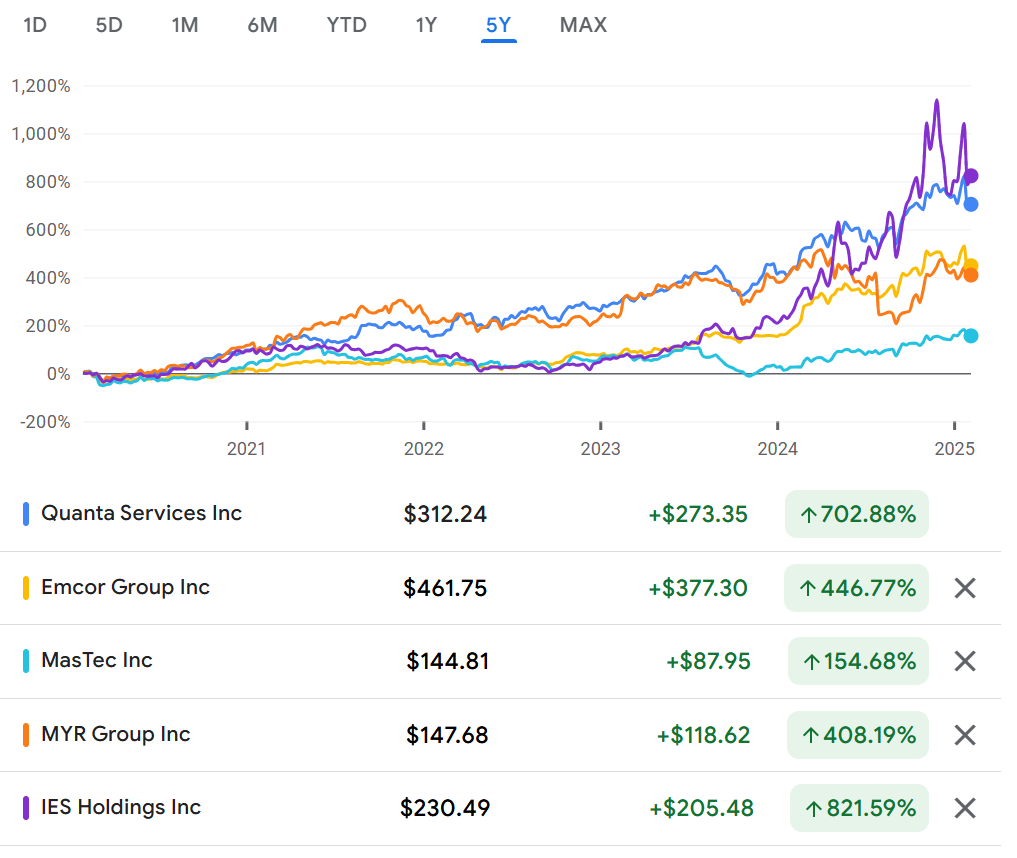

Over the last five years, the entire industry, including $IESC and its competitors, has experienced remarkable growth, as shown in the chart. Driven by strong industry tailwinds such as increased demand for infrastructure modernization, renewable energy, and data center expansions, all major players—Quanta Services (+702.88%), EMCOR Group (+446.77%), MasTec (+154.68%), MYR Group (+408.19%), and IESC (+821.59%)—have delivered exceptional returns. This performance underscores the resilience and opportunity within the infrastructure sector, positioning IESC and its peers as key beneficiaries of ongoing market trends.

Additionally, IESC has a forward P/E (NTM) of approximately 20x, placing the company in the lower valuation range compared to its peers, while achieving growth that is 2 to 3 times faster.

3.6. Growth Potential

IESC’s robust positioning in rapidly growing markets, coupled with its operational discipline and strategic foresight, suggests a strong runway for long-term growth. The company is primed to benefit from macroeconomic trends and sector-specific opportunities, making it a hidden gem in the infrastructure space. As mentioned, it includes several attractive factors that suggest it could be a strong investment opportunity in the coming years:

Industry tailwinds.

Revenue diversification.

Strong competitive position.

Operational excellence.

Fair valued/undervalued growth opportunity.

Conservative founder with skin in the game.

4. Management Quality

4.1. Experience

IESC’s management team has decades of experience in construction, infrastructure, and finance, ensuring prudent decision-making. The team’s track record includes successful navigation of economic cycles and strategic pivots to capitalize on new opportunities.

4.2. Management Shares Ownership

Jeffrey L. Gendell, founder, Chairman and Chief Executive Officer of IES Holdings, Inc. (IESC) owns ~55% of outstanding shares, demonstrating strong alignment with shareholders. This level of insider ownership reflects confidence in the company’s future prospects.

Jeffrey L. Gendell, has maintained a relatively low public profile, with limited personal opinions or interviews available online. His professional background includes founding and managing Tontine Associates, L.L.C., a private investment management firm that is the majority shareholder of IES Holdings. Mr. Gendell has been leading IES Holdings since October 2020.

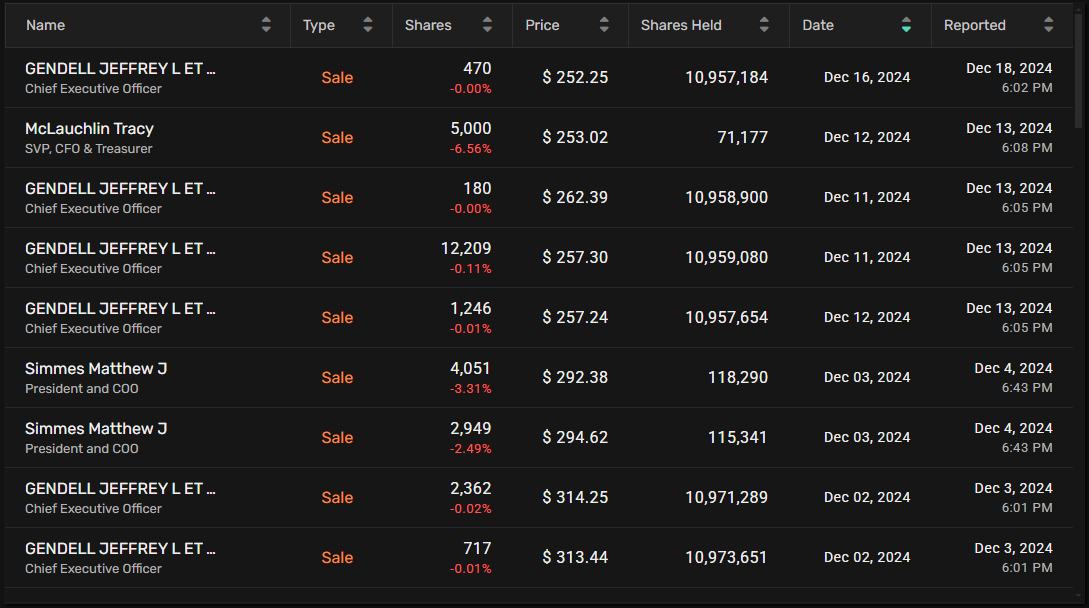

He has recently been selling shares at prices above $250, which can be viewed as the actions of someone who has already achieved substantial success and ended the game. It’s understandable to see him continuing to sell shares. Despite this, his position in the company remains very strong.

However, insider trading activity significantly decreased in the last quarter of 2024.

4.3. Executive’s Compensation

Executive pay is performance-linked, emphasizing long-term shareholder value. Compensation structures incentivize sustainable growth and operational efficiency.

Mr. Gendell's 2024 compensation ($4.7 million) is relatively low compared to his stake in the company, which exceeds $2.5 billion.

4.4. Shareholder Treatment

The company’s capital allocation strategy prioritizes reinvestment and buybacks over excessive dividends, reflecting a growth-oriented approach. Shareholders benefit from a disciplined focus on long-term value creation.

Shares have maintained steady over last 10 years, and recently IESC authorized a stock repurchase of $200 million, remaining $193.7 million by the end of 1Q2025.

The stock repurchases achieved $44 million in 2024.

5. Competitive Advantages

Keep reading with a 7-day free trial

Subscribe to Swiss Transparent Portfolio to keep reading this post and get 7 days of free access to the full post archives.